Online payment software facilitates payments. After you click the "buy" button on a website, the payment software will ask for your name, your billing address, and your card or bank details. Then, it will check with the bank to make sure all the information is correct before charging you. Once the payment is complete, it sends a signal to the store website to announce payment success, and the site will confirm your order.

Say you’re buying shoes online. You put the shoes in your shopping cart and click the buy button. Then, the website asks for your shipping address. After the website calculates any extra shipping costs and taxes, it will ask for payment. That's when the payment software comes in.

In fitness, online payment software usually integrates with booking software. For people wanting to book a class, this makes the process of 1) reserving their spot and 2) paying for a class seem like one task instead of two. A fitness customer can use TeamUp to book and GoCardless to pay, but they don’t really notice that it’s two completely different companies that are separate from yours.

How are online payments different from cash?

The number one biggest reason that people give us for finally getting payment software is that it’s difficult to stay on top of payments when you’re running a class-based business. Handling cash is a nuisance, and tracking it is a chore.

To see what we mean, imagine these instances:

| Scenario | Cash | Online Payments |

|---|---|---|

|

Customer books class |

Customer calls in, fills out a google form, or reserves a class online |

Customer pays for the class in advance at the same time as booking |

|

Customer cancels class 2 days ahead |

Nothing happens |

Payment is returned, and their place is re-opened. The first person on the waitlist is notified that a space is available |

|

Customer misses class |

You have to chase them for payment, or let it go |

You have your payment |

|

Customer arrives to class |

You collect their payment before or after class. Make sure you have change for them |

You greet them and introduce yourself. You have time to show them the studio |

|

A week later you check: did they pay? |

You check your books. Did you make sure to mark off that they paid? Did your instructor account for the cash? |

Payments taken automatically. Booking system like TeamUp alerts you to any issues. Otherwise you can be confident that everything is running smoothly |

|

You need to make business decisions: look at income changes over time |

Your ability to understand your business is as good as your commitment to keeping manual records |

You have all the information needed anytime you need it, plus reports to help you cut through the complexity if you have a system like TeamUp |

|

You realise you need to keep better records |

Hire someone to keep track of every payment and make reports |

You have all the history so this is not an issue. If you don’t have a booking system then the payments may not be linked to classes or memberships |

|

End of year taxes are due. How do you calculate your income over time? |

You take your bank statement as the main source of information but risk accounting incorrectly and facing fines if you are investigated |

You export a report and send it to your accountant or your accounting system |

Why are online payments helpful?

Because business owners typically hate dealing with money.

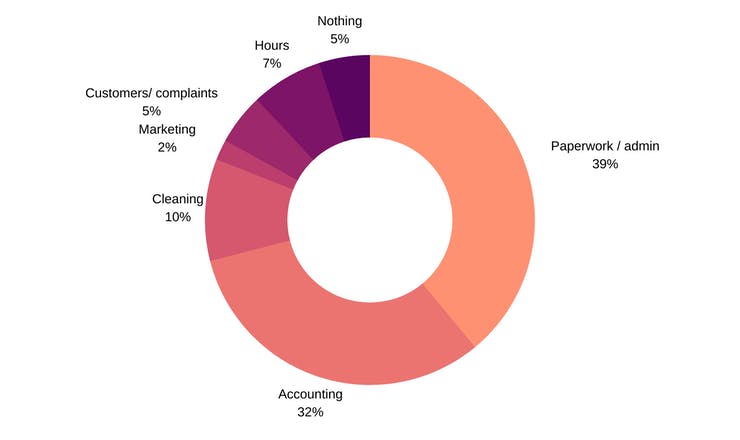

How much do fitness business owners hate dealing with money? When we asked 283 fitness business owners from across the UK “what’s the worst thing about your work?” Paperwork and admin came up first, and accounting came up second.

Together, “money stuff” made up a massive 71% of fitness business owners’ most hated things:

Manual payments are a pain in the neck. They take up a lot of time at the start and end of classes. You often have to hire someone to do the job for you.

Rather than wasting time at the start of classes, most fitness studios use online payment software. When we spoke to customers about this, they explained how this helped their business:

I was spending a ridiculous amount of time answering questions about my events, giving payment details and then having to check the payments had been made. Tracking everyone who was on each session and then dealing with refunds or credit, all via an excel spreadsheet was just too time-consuming, confusing and frustrating for my clients

I had too many clients and classes to cope with manually. I was spending all my time dealing with class bookings and payments and not enough time talking to my customers.

Some people wanted to free up admin time to walk their dog or play with their children. Others didn't like dealing with cash at the door because of the awkwardness when customers forgot to have cash on them.

Lots of fitness businesses come to us after they’ve started out successfully with cash payments. As their studio gets busier or bigger, or they start to hire instructors, they realise they want a system in place. For them, it’s a natural stage of growth. Some business owners decide they want payment software right away. So, they use TeamUp for booking and an online payment processor for payments.

Now you know what an online processor does. But, how do you choose which one to use? we help break it down here: